Doctor shortages

Where Have All the Doctors Gone?

Health Systems Must Learn to Better Compete for Physician Talent to Confront an Existential Threat

By Chris Smedley, Semyon Shtulberg and Andy Ziskind

The COVID-19 pandemic painfully magnified the need for physicians, but the reality is that demand has been outpacing supply for many years. Now, compounding factors are exacerbating this shortage and intensifying the competition for physician talent to unprecedented levels.

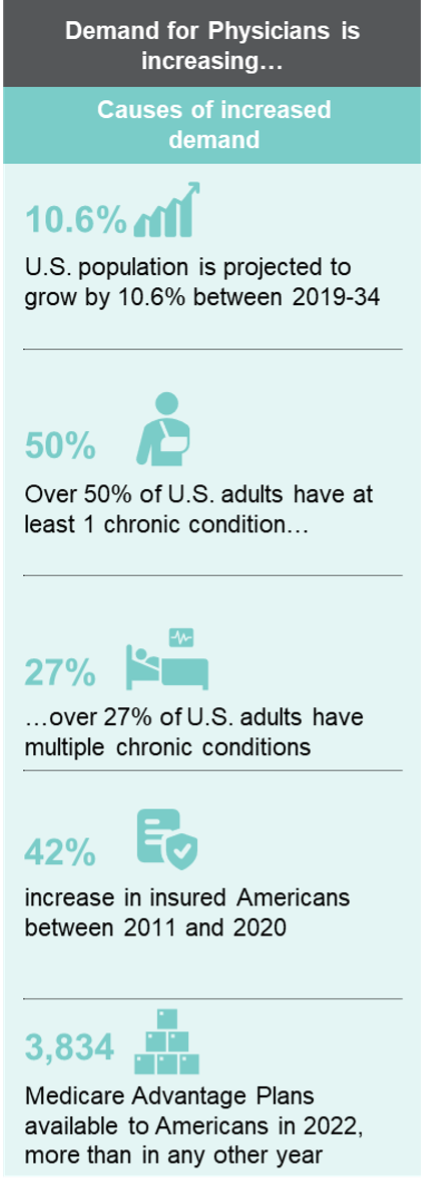

A growing U.S. population is also becoming older and sicker. A majority of adults suffer from chronic illnesses, and more than a quarter are living with two or more comorbidities. Baby Boomers have entered the stage of life where they need more care. In response to these trends, CMS and CMMI are expanding opportunities for providers to take financial risk for the growing MA population by offering expanded reimbursement models, making physicians even more valuable and raising the stakes for retention of high-quality physicians and practices. The anticipated insolvency of the Medicare trust further accentuates the shift toward risk.

On the bright side, due to the Affordable Care Act and near record low unemployment, the past decade has seen an additional 40 million people obtain either private or public health insurance. The industry has responded by creating many new points of access in retail, digital and virtual settings. This too, has contributed to the need for more physicians.

The last several years have seen the acceleration of a steep change in the structure and alignment of the U.S. health care system and providers. The impacts are being experienced by a variety of stakeholders – health systems, providers, owners, investors, payers, patients and many others.

Indeed, nearly everyone has witnessed or experienced some of the symptoms of these changes. Health care job turnover is at record levels, with many people changing roles, employers or leaving the field altogether.

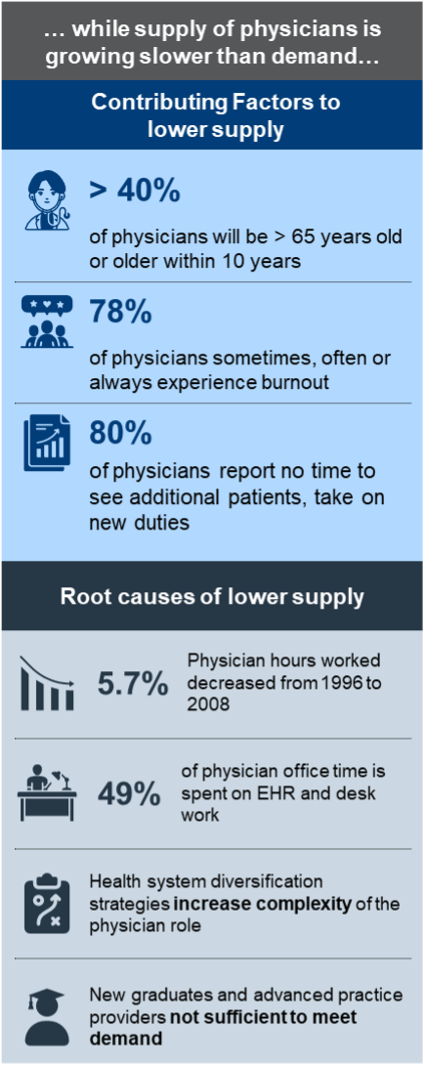

Burnout is reported by as many as half of physicians who are part of Generation X. Other cohorts find themselves less impacted by burnout but are still troubled by the commitment and sacrifices required by some aspects of their jobs. It is not unusual today to hear some health care providers lament the fact that they find the practice of medicine no longer fun or fulfilling. As many as four out of five physicians report no time to see additional patients or take on new duties. Health system revenue diversification strategies -- which often require alternative care models and adoption of digital technologies -- have increased the complexity of the physician role.

When looking at these symptoms, it is important to dig deeper into the underlying causes. Reports of physicians considering early retirement, complaining of burnout, feeling overwhelmed by competing priorities or failing to obtain a coveted medical school spot are not just anecdotal reflections. Data indicates that physicians are working fewer hours and spending nearly half of their office time at their desks rather than examination rooms. Through experience, we know that the corporate demands of health care are increasingly pulling physicians from the bedside to the boardroom, and the current rate of new graduates is not nearly enough to fill the spots of those retiring or leaving the profession.

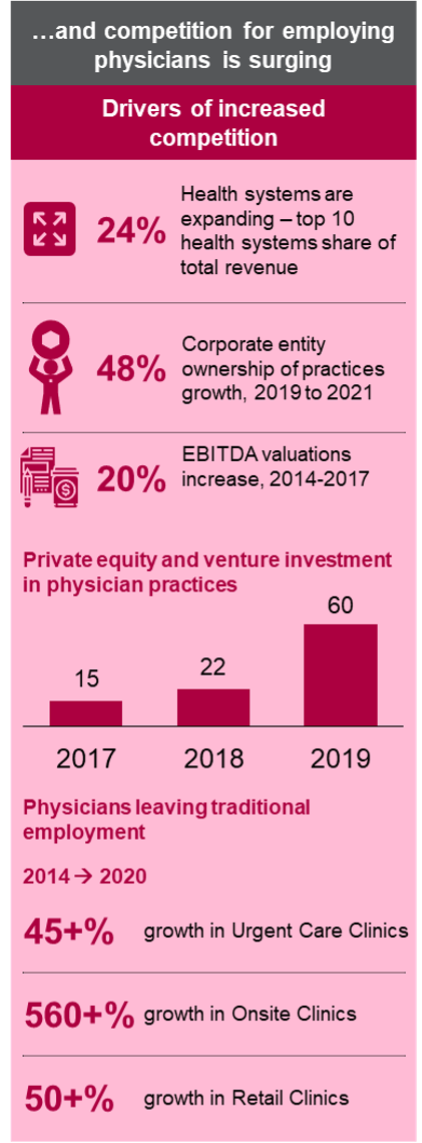

Providers today have more employment options than ever before. While health systems are growing in scope of services and geographic reach, corporate, private equity and venture capital ownership of practices has increased dramatically. Non-traditional venues such as urgent care facilities, on-site clinics and retail clinics are rapidly expanding nationwide, with both new entrants (e.g., One Medical, Oak Street Health, VillageMD) and major corporations (e.g., Apple, Amazon, Walmart) all opening clinics of their own.

The new entrants are not just providing new points of delivery. They are also assuming risk as a foundational part of their business model, which allows for direct contracting and other non-traditional relationships. They are aggressively recruiting providers in various subspecialties, including primary care. Payer entities and Optum are actively employing physicians, and the latter is now the largest employer of physicians in the country. At the same time, single specialty aggregators are aligning specialists and moving profitable services away from the health system facilities.

These new entrants are not bound by fair market value constraints of health systems. As a result, they can offer more lucrative practice purchase options. And many new entrants are actively “courting” physicians and practices, sometimes competing with one another as well as health systems. Providers are happy to entertain multiple offers and, in a contest of shiny new objects, health systems face an uphill battle.

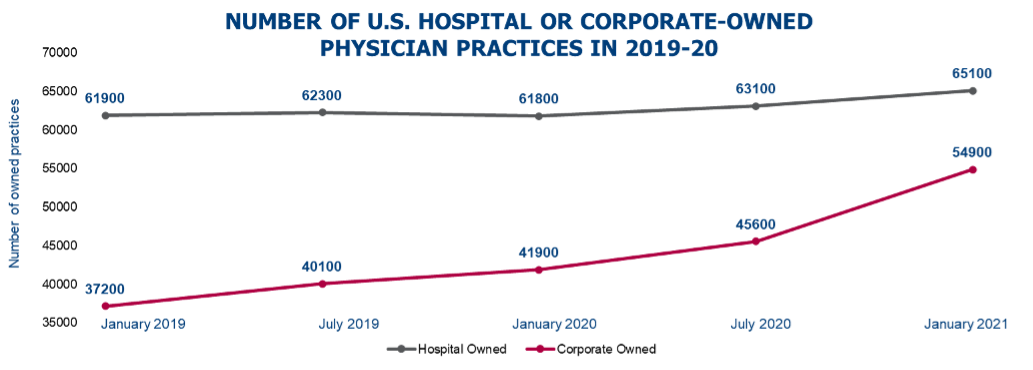

Between 2019 and 2021, corporate ownership grew by 48% while hospital ownership grew just 5%, according to the IQVIA database. Corporate owners acquired more than 5 times as many practices during this period. This trend has allowed corporate owners of physician practices to reach levels of employment just short of hospitals. It is projected that they will likely surpass hospital systems in terms of owned practices in the near future.

If this trend continues, health systems and hospitals may soon find that they not only lack the physician complement needed to grow their services but may also be forced to reduce volumes and close locations due to a lack of physicians needed to serve their patients.

How can leadership teams of health systems manage through these issues?

A critical element to success is more effective alignment of leadership across the health system, especially between the physician organization and hospital, regarding key priorities and initiatives that address clinician needs and challenges. Creating and reinforcing an environment of engagement that recognizes the need for clinician voice in decision-making and management is essential to retain and attract the physician talent necessary in the current and future operating environment.

Do not assume you know what your physicians are thinking and needing. Ask yourself these three basic questions:

1. How can we focus on improving the quality of day-to-day practice? What can we do to reduce the administrative burden, reduce burnout and restore joy to the professional practice of medicine?

2. What can we do to strengthen the relationship between hospital and health system and physicians, ensuring that physicians have an authentic voice in decision-making?

3. How do we proactively engage physicians now, so that we are not on the defensive once they have made the decision to leave?

It’s critical to act now to preempt the disruptive forces working to dislodge traditional physician and health system relationships. Retention only gets harder once additional employment options are in play, and risks are compounded considering most health systems’ need for growth. Health systems that are not already actively working on each of the choices above must start now or face disruption of their physician workforce in the future.

Chris Smedley (chris.smedley@BDCAdvisors.com) is a managing director at BDC Advisors, Raleigh, N.C. Semyon Shtulberg (semyon.shtulberg@BDCAdvisors.com) is a principal at BDC Advisors, Milwaukee. Andy Ziskind, M.D., (andy.ziskind@BDCAdvisors.com) is a managing director and CEO, BDC Advisors, Dallas.

Please note that the views of authors do not always reflect the views of the AHA.