Innovation

Disrupting the Health System from Within

Hospital leaders should make bold moves to keep competitors at bay

By Mitch Morris, Tina Modi and Jonathan Felix

As the health care industry goes through changes, legacy health systems face an increasingly challenging environment with deteriorating financial performance due to rising costs (complicated by the pandemic), pressures on reimbursement, shifting case mix and accelerating competition from alternative sites of care. But perhaps more importantly, their core mission is at risk of disintermediation and commoditization by well capitalized new competitors: health plans, private equity, retail and big tech.

In the past, most health care industry sectors were well-defined. A payer was a payer, a provider was a provider. Over the past five years, a significant influx of capital from large payers, retail and private equity has essentially erased the swim lanes. These deep pockets have been able to place some bets while the non-profit health care sector and smaller payers have largely been left out, in what the Kaiser Family Foundation has called “private equity’s stealthy takeover of health care.” We explore how leadership of health systems can tackle these challenges and set a bold path forward.

Health Plans (“Payviders”)

The largest U.S. health plans are looking for growth outside of the commercial benefits market which is largely an Administrative Services Only (ASO) model for self-insured employers. Large plans have expanded into Medicare Advantage (MA) and managed Medicaid and seek to also differentiate their programs for large employers. The increased enrollment in government programs has helped increase revenue and valuations. They are now reaching for other means of managing health care costs and outcomes which go well beyond the traditional definition of “benefits manager.”

MA programs in 2023 account for over 50% of all beneficiaries and this number is expected to rise to well over 60% in the next few years. This line of business has been very attractive to payers, especially the large national systems. Most beneficiaries in MA programs are in an HMO product and this enables health plans to utilize both the primary care gatekeeping function and narrow specialty networks with the goal of managing total cost of care (TCOC).

Similarly, payers have been increasingly pursuing managed Medicaid contracts at state levels where the goal is managing TCOC and improving outcomes. Payers are also making investments in home health and senior living. Larger health plans have developed some of these capabilities in house but there is also an industry of companies, especially those that leverage digital tools and analytics, that has grown around this need. These services impinge on the traditional role and structure of the provider and health system.

Finally, the investment by health plans in primary care has further potential to marginalize the traditional health system. For example, Optum (UnitedHealth Group) has engaged with over 70,000 physicians, the majority of which deliver primary care. To put this into perspective, the U.S. has roughly 650,000 physicians who provide direct patient care and less than a third of these are primary care. In the past two years, Elevance, CVS Health/Aetna, Humana and others have made major investments in primary care. The parent company benefits not only from the direct revenue from the medical groups, but, on a strategic level, from the potential to lower the TCOC, which may help to differentiate the payer on premiums, growth and profitability.

Retail

Large retailers and pharmacies have long had an interest in expanding their health care footprint but to date have had little impact. In the last year they have doubled down with major investments in primary care with a stated goal of delivering lower cost health care in a consumer-centered model. While the initial thinking around CVS MinuteClinics and similar in-store centers was to stimulate collateral sales, this model was sub-scale and underutilized.

By pairing with major primary care groups, retailers are taking a fresh and more focused approach that is intended to be attractive to employers and payers by lowering medical costs overall with more accessible and effective primary care.

The retail side of CVS Health is well positioned with its ownership of Aetna, Caremark and the announced acquisition of Oak Street Health. Walgreens (Village MD), Walmart (Oak Street) and Amazon (OneMedical) are all making bold plays in this space and have pharmacy capability to impact drug spending and consumer convenience. The potential impact on health systems is further disintermediation, especially if these retailers succeed in their stated goal of expanding beyond urgent care visits into the management of chronic illness.

Private Equity (PE)

Medical groups and ambulatory infrastructure continue to be aggressively courted by PE in many areas including primary care, women’s health, cardiology, GI, orthopedics, anesthesiology, dermatology, hospitalists and more. A Bain & Company report estimates that PE invested $151 billion into health care in 2021, nearly double the 2020 total. A near-term goal is to maximize profit through increased billing (cost to the risk holder), a goal that runs contrary to the needs of systems to lower costs. PE-funded groups and facilities directly compete against the ambulatory footprint of the health system and are eroding their margin from specialty services. Additionally, because PE is often paying over fair market value, health systems typically do not have the capital nor desire to compete on the purchases.

Employers

In 2022, the average annual premium for employer-sponsored health insurance was $22,463 for family coverage. On average, employers pay 83% for single coverage employee health insurance plans and 73% for family coverage plans. A study by the Baker Institute at Rice University notes that companies that deploy best practices in their employee insurance programs have a median potential gain in profits by lowering health care spending of $1,373 per employee per year, which equates to 3.5% to the bottom line.

Employers are focused on traditional approaches (pushing employees to narrow networks and HMO plans) and, with plans, co-sponsoring innovative care management and digital approaches to health (such as Virtual First) to lower their costs and improve employee health. The bottom line is that employers need partners to succeed in lowering costs.

Consumers

Expectations following the pandemic, generational change and the overall tech-driven consumer experience are leading people to choose health care that is accessible, convenient and that delivers value (low out-of-pocket expense). There has been a generational shift to app-based services and health care is no exception. Traditional health systems are not viewed this way and consumers/members/patients are now receptive to virtual and digital care.

Health system leaders have long known that the fee for service acute care model is likely to be disrupted, yet they are reluctant to move on from the current model. There is no shortage of good intentions and creative ideas but when the implications on revenue, capital and cost are understood, the change we see tends to be tentative and incremental rather than bold. Their access to capital and skills at managing costs have led the national health plans and retail players to make some bold plays. Time will tell if they are successful, but it is clear that health systems should consider their own strategies and bold moves for the next 5–10 years.

Table Stakes

To embark on new directions, health systems must have their own house in order. Without including investment income, most have recently reported negative margins. An intense focus on managing operating costs and revenue is needed to invest in change from a position of strength.

The other table stakes include:

- A high performing and competent leadership team that can both operate and overcome cultural inertia.

- Driving post-merger integration activities to a successful conclusion to achieve synergies.

- Providing a positive patient experience and engagement.

- Developing the ability to manage risk (defined as the costs that contribute to the overall TCOC).

- Confirming the organization has sufficient volume and market share in their service area(s) to enable market shifts to new models.

- Physician alignment to build volume and quality.

- Asset agility by redefining not only what to start or continue doing but also what to stop doing, which includes the future resilience to manage market shifts.

New Capabilities for Health Systems

Health systems must identify their place in the ecosystem that is sustainable and aligned with their mission. Understanding these challenges and threats is the first step to outlining a path forward. Besides taking care of the table stakes, below are some key additional capabilities for health systems that enable them to address the critical challenges to ensure sustainability and relevance.

Enabling of Care Anywhere

The COVID pandemic has shown consumers that care may be delivered at any location and anytime, with technology being the key enabler. Today there are over 1,900 digital health companies that have raised at least $2 million in venture funding. Investment capital has surged into early-stage companies with a focus on consumer-friendly access to clinical tools such as telehealth visits on demand, home visit programs and a plethora of digital devices, apps, tools to wear, have at home, run on smart devices that share with relatives/caregivers. Some of these innovative approaches to care can be reimbursed under existing codes, but many, especially emerging digital tools, cannot. This makes it difficult for the health system to implement since they cannot create claims that result in third-party payments.

Nearly all are aimed at lowering the utilization of in-person clinical encounters which are reimbursed and nearly always at a higher rate. The benefit of this approach is not only a substitution for in person visits but also better maintenance of improved health and reducing the cycle of episodic care for acute illness. Emerging categories of digital health companies are beginning to become impactful.

Effective Management of Chronic Illness

According to a 2018 Milken Institute study, costs for diabetes, COPD, cardiovascular, kidney and other chronic diseases in the US surpass $1 trillion annually. Major cost drivers include inpatient stays and pharmaceuticals (especially specialty drugs). Traditional management with periodic clinical visits punctuated by episodic flare ups is a scattershot approach that does not properly address issues of medication and dietary adherence and social and health equity issues.

Neither does the traditional approach fully recognize that managing chronic illness is a continuous process, not episodic. Emerging digital monitoring tools and apps, wearables, coaches, home clinical visits, and adherence programs have all been shown to move the needle. While payers are investing in these approaches, providers have been slow to adopt in part because there are often no reimbursable codes, and the resulting lower clinical utilization erodes clinical encounter volumes. Telehealth in general and the move by payers to “virtual first” can further disintermediate health systems.

The recently announced partnerships between General Catalyst and several health systems to create a “digital health ecosystem” seems to be intended to address these capabilities. Medicare Advantage programs offer some incentives that will likely grow but at an order of magnitude that is too low to drive provider investment. By directly taking financial risk outside the fee for service structure, providers will have the incentive to fully embrace disease management with the lower costs that come with it.

Primary Care Network and Medical Group Alignment

As HMO-based MA, Medicaid and employer-driven programs expand, the role of the primary care clinician will increase in relevance to health systems. Guiding referrals to specialty physicians and facilities that are in network will impact health systems that do not participate in this arrangement. Hosting, employing and partnering with primary care providers will be critical to maintaining volumes. With primary care organizations taking risk, they will drive volume to systems they perceive as supporting their approach.

Maintaining and building strong overall physician alignment with specialty providers is also critical, especially as PE continues to aggregate specialty groups. To respond, health systems must have a well-defined approach that addresses not only their economics, but also issues driving burnout, including a clinical environment that aligns with their physicians’ personal goals.

Pharmacy Alignment

Drug costs will continue to rise for the foreseeable future especially due to new and costly specialty drugs which continue to fill the market. Even though less than 2% of the population uses specialty drugs, those prescriptions account for 51% of total pharmacy spending. Managing TCOC and promoting medication adherence will require a carefully curated formulary approach, specialty drug management programs, and coordination with care management programs. Providers who take on the risk of managing chronic illnesses will need to proactively manage this cost.

Payer Alignment

For health systems to manage the cost of care, the health plans must be aligned. Even the few systems that operate health plans at scale struggle between the internal conflicting financial goals of being a payer and a provider. Well-constructed payer/provider partnerships with defined goals and decision rights are a path to strong clinical and financial outcomes and increasing market share. All three lines of business — commercial, Medicare and Medicaid — can be sustainable models that differentiate the participants in the markets they serve.

Dabbling with Change

Often, health system leaders dabble with adoption of new business models, with a part time focus on a series of initiatives. The lack of focus is compounded by financial limitations, legal red tape and political challenges. To truly achieve durable results, a different approach is needed.

Disrupting From Within

With the recognition that a series of bold steps are needed to keep health systems as the overall coordinators of care, they should consider innovative business models that reassign some of their best leaders with a mandate to focus only on the new models. They should receive capital and specific goals to build and operate these new capabilities even when they may directly compete with some of the immediate financial goals of the parent system. This may mean creating a Newco (also known as a corporate spin-off, startup, or subsidiary company before they are assigned a final name) that is for-profit. Depending on scale, regional market factors and access to capital, choices need to be made between building, buying and partnering for these new or scaled capabilities. Most will choose a hybrid approach that matches their unique position. Critical success factors include a strategic roadmap, a dedicated leadership team with funding and a mandate.

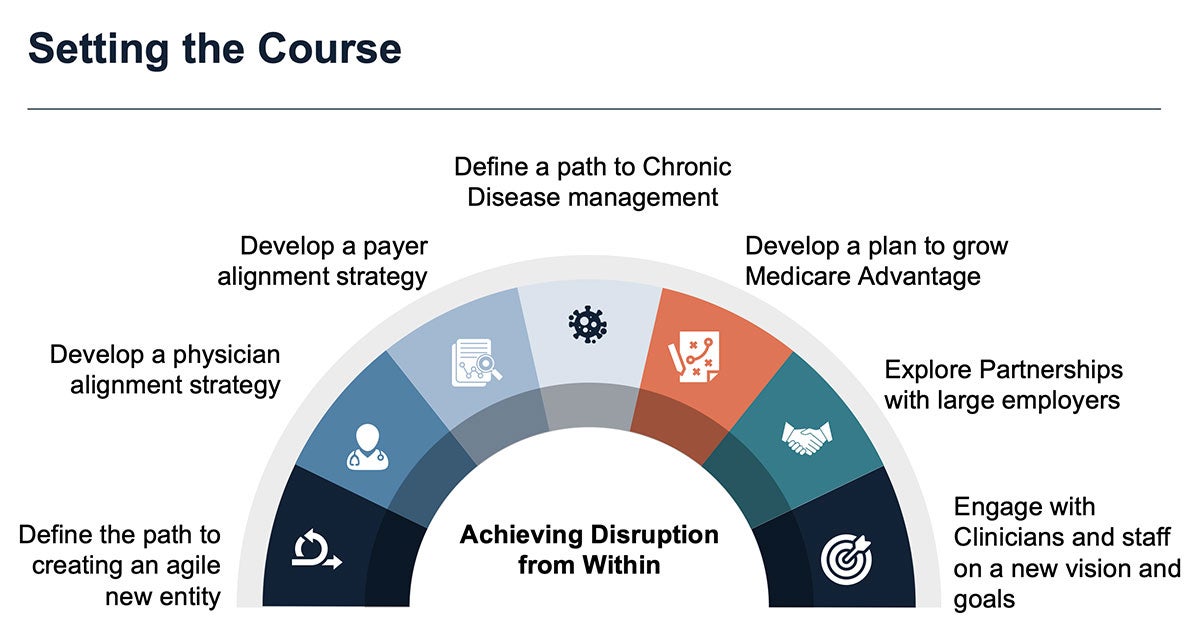

Setting the Course

There are several proactive steps that systems can take to develop a multi-year bold play in the markets they serve:

- Perform a market analysis not only of traditional competitors, but of potential disruptors. They may already be in the region. This analysis should identify not only threats but also the opportunities for securing market share.

- An objective assessment of the current health system service areas, including what areas to continue within the traditional model.

- Determine which legacy capabilities are no longer strategic or sustainable.

- What are gaps in capabilities such as primary and specialty care alignment, Care Anywhere, telehealth, digital, disease management, etc.?

Strategic Roadmap

With this assessment as a base, health systems can create a 7-part strategic roadmap that is able to:

1. Define the path to creating an agile new entity (likely for profit) outside the existing enterprise that is unencumbered by the priorities of the parent system. This Newco can house parts of the business focused on lowering TCOC and managing risk. This will often involve developing alternative revenue models outside of the fee for service-defined world of health care today.

2. Develop a physician alignment strategy for a value-based world that includes primary, specialty and virtual care components. This includes consideration of acquisition, organic growth, or aligned partnership models. To properly incentivize medical groups, they may be best placed outside the legacy system. Care must be taken to design these models so that Stark and anti-kickback laws do not become issues.

3. Develop a payer alignment strategy based on creating a value-based model at scale. For those systems that own a sub-scale health plan, this may include creative deals to align with a larger player for MA and commercial businesses that drives greater volumes to both. This is also an opportunity to partner on other aspects around physician alignment, consumer engagement, digital health, virtual first and other priorities.

4. Approach chronic disease management with a focus on lowering costs and improving clinical outcomes, by leveraging the Care Anywhere model. This is critical so the health system remains the overall care coordinator and not just an expensive cost center. Disease management includes proper utilization of specialty drugs and their costs.

5. Develop a plan to grow MA, with the knowledge that this benefits model allows for innovative approaches to health maintenance. In some markets, managed Medicaid and commercial risk may also be strategic objectives.

6. Explore partnerships with large employers with a focus on lower costs through the new entity to drive volume and engage with employees.

7. Engage with clinicians and staff on a new vision and goals for the role of the health system to attract, grow and retain top talent.

Mitch Morris, M.D., ( mitch.morris@bdcadvisors.com) s a Senior Advisor with BDC Advisors and is a distinguished healthcare strategist and physician executive based in Dallas. Tina Modi (tina.modi@bdcadvisors.com) is a Managing Director with BDC Advisors based in Nashville. Jonathan Felix (jonathan.felix@bdcadvisors.com) is a Principal with BDC Advisors based in Denver.

Please note that the views of authors do not always reflect the views of AHA.