Innovation

Catching up to Consumer Expectations for Access

Organizations must rethink their approach to build customer engagement and loyalty

By Kaufman Hall & Associates, LLC

Editor’s note: This article is a shortened version of Kaufman Hall’s report “2019 State of Consumerism in Healthcare.” Click here for access to the complete report.

Health care continues to play catch-up in an online, convenience-obsessed, and increasingly consumer-focused world.

Results of Kaufman Hall’s 2019 Healthcare Consumerism Index highlight the challenges that legacy health care providers face in trying to grasp a firm handhold on the ever-rising bar of consumer needs and expectations. The Index provides a lens to industry performance related to consumerism, based on survey responses from hospitals and health systems nationwide.

Top performers kept pace with previous years, while many lower performing organizations fell further behind. Falling scores in the area of “access” contributed to much of the backsliding among lower performers. It is not that these organizations reversed course on consumer initiatives, but rather that they struggled to adjust to continually changing expectations for what defines “great access.”

The Threat of Disintermediation

Health care leaders nationwide acknowledge the risks, as numerous competitors seek to disrupt traditional care delivery models. A majority of respondents to this year’s survey — 88 percent — agree or strongly agree that hospitals and health systems are vulnerable to consumer-friendly offerings from non-hospital competitors, compared to just 8 percent who disagreed.

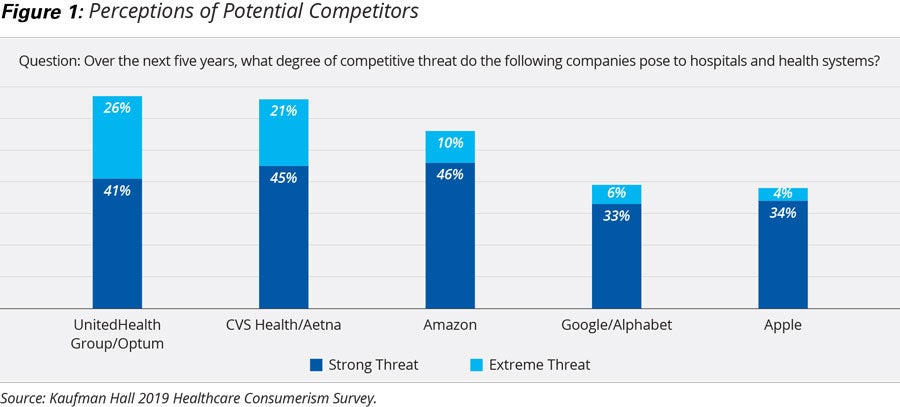

When asked to rank potential competitors, survey respondents cited UnitedHealth Group/ Optum, CVS Health/Aetna, and Amazon as posing strong or extreme threats (see Figure 1: Perceptions of Potential Competitors). Respondents view companies with less of a health care focus — such as Google and Apple — as less of a threat.

Priorities vs. Capabilities: A Growing Gap

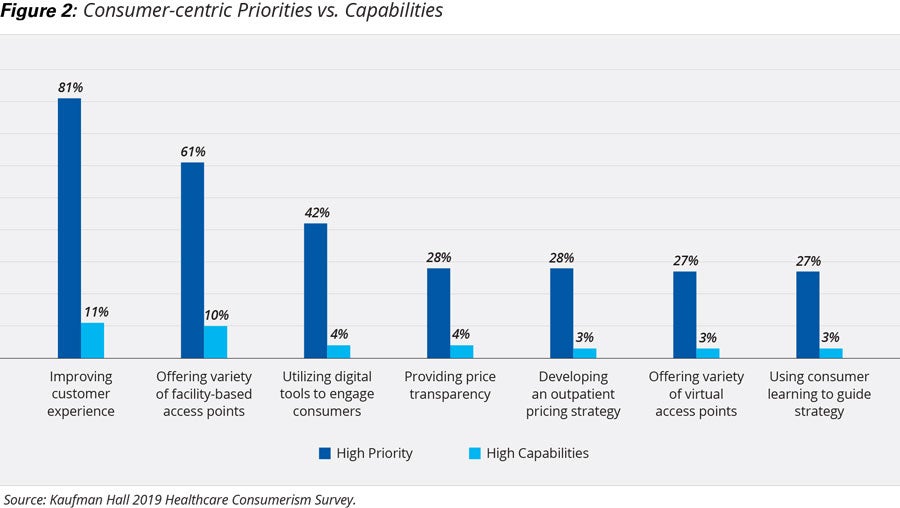

Each year, the Kaufman Hall Consumerism Survey seeks to gauge the level of alignment between organizational priorities and capabilities relative to consumerism initiatives. This year’s findings reveal a steep divide between those that rank key initiatives as “high” or “extreme” priorities and those with high capabilities in those areas (see Figure 2: Consumer-centric Priorities vs. Capabilities).

A majority of respondents (81 percent) identified improving the customer experience as a high priority for their organizations, while only 11 percent reported having best-in-class customer experience capabilities. Surprisingly, 20 percent said improving customer experience was a moderate-to-low priority, and more than a quarter said an enhanced customer experience was either not available or had limited availability at their organizations.

In terms of access, legacy providers continue to focus more on developing brick-and-mortar facilities than expanding digital tools or virtual services. Sixty-one percent of survey respondents identified “offering a variety of facility-based access points” as a high or extreme priority for their organizations, while 10 percent said their organizations are “best-in-class” in this area. More than a quarter said having a variety of facilities was a moderate priority, while 62 percent said their organizations already offered such access points on a widespread basis.

In contrast, just 27 percent cited “offering a variety of virtual access points” as a high priority for their organizations, and only 3 percent said they were top performers in this area. Nearly 30 percent said offering a variety of virtual access points was a low priority, and 63 percent said such access points were either not available or offered on a limited basis at their organizations. Forty-two percent of respondents identified “using digital tools to engage consumers” as a high-to-extreme priority, while 35 percent said it was a moderate priority and 21 percent said it was a low priority. Thirty-two percent said such tools were widely available.

When asked what most differentiates their organizations from competitors, most respondents cited the quality of clinical outcomes, geographic coverage, and accessibility of care. At the other end of the spectrum, respondents indicated factors such as price and “innovative products and services” as the least differentiating factors.

Consumer Access: The Bar Gets Higher

Overall performance in consumer access fell this year, due in large part to a higher bar in terms of what defines good access for the Kaufman Hall Consumerism Index, based on the firm’s extensive research into changing consumer needs and attitudes. Today’s consumers increasingly demand quick and easy access to any and all services through a variety of access points — physical and virtual — with digital tools to add convenience. Rising expectations require health care providers to work that much harder to meet consumer needs.

Just 9 percent of organizations rated as top performers for access, down 3 percentage points from 2018, while the lowest performing organizations rose 20 percentage points over last year to 30 percent.

This swelling of organizations in the lowest performing group is due, in part, to a persistent focus on relatively traditional physical access points. Historically, legacy providers have emphasized building brick-and-mortar care sites, as opposed to first understanding consumers’ health care needs and determining how best to address those needs through a variety of modalities.

As in previous years, the majority of survey respondents indicated that they offer widespread urgent care (61 percent), ambulatory surgery centers (51 percent), and freestanding diagnostics facilities (41 percent). By comparison, nearly half said their organizations had no retail clinics.

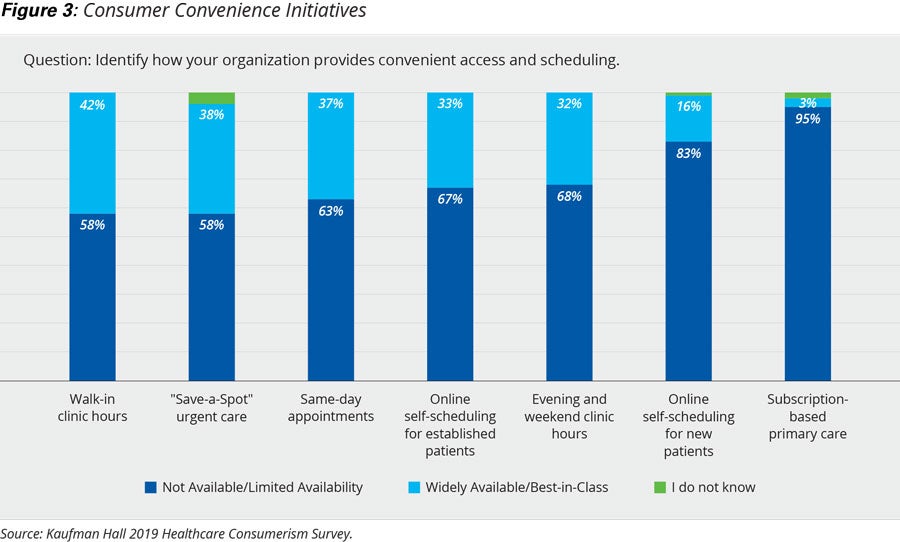

Looking at access initiatives aimed at increasing convenience for consumers (see Figure 3: Consumer Convenience Initiatives):

- Nearly 80 percent of organizations report having no subscription-based primary care services.

- A third offer widespread online self-scheduling for existing patients, but few offer this service for new patients.

- Same-day appointments and extended and walk-in hours are common access strategies.

- Thirty-eight percent of respondents offer widespread “Save a Spot” urgent care, while nearly 60 percent offer it on a limited basis or not at all.

Legacy health care providers need to rethink their approach to access if they want to appeal to today’s consumers, said a senior strategy officer with a major health system in the Northeast.

“The old, traditional ways of access are not what people want,” he said. “Everything is online and on the app of a phone. It’s not just about one interaction or one moment in time, it’s about building customer engagement and loyalty.”

Consumer Access: Best Practices

Kaufman Hall’s research shows the following best practices for developing state-of-the-art consumer access:

- Start with how best to serve consumer needs, rather than asking “how many facilities do we need?” or “which real estate should we purchase?”

- Identify new growth-oriented metrics to determine access success, such as new, unique patients captured.

- Provide multiple options across physical, virtual and convenience dimensions for consumers to access your system — consumers are not homogeneous in their preferences and needs.

Consumer Experience: Efforts Remain Limited

As noted earlier, 81 percent of survey respondents identified improving the consumer experience as a top priority for their organizations. While many organizations are making progress, significant room for improvement remains across the board.

Enhancing communication has been a clear focus area for many hospitals and health systems, with a majority of respondents reporting widely available automated appointment reminders (72 percent), and centralized call routing (53 percent). Fifty-five percent of organizations have widely available electronic messaging between patients and providers, while 34 percent have it with limited availability. Thirty-nine percent of respondents said their organizations offer same-day communication with a provider by phone on a widespread basis, while 53 percent provide limited availability to such services.

Real-time communication offerings are particularly lacking:

- Sixty-six percent of organizations offer limited-to-no opportunities for real-time patient feedback.

- Nearly three-quarters of respondents said their organizations have limited-to-no real-time referral scheduling.

- Half of organizations offer no real-time updates on in-office wait times, while 38 percent offer such updates on a limited basis.

To deliver a great consumer experience, executives must make it a cultural priority throughout their organizations, supported by the necessary workflows and enabled by the right technology. Health care leaders should strive to offer an experience that’s on par with leaders across industries, not just those within health care.

Consumer Experience: Best Practices

Kaufman Hall’s research shows the following best practices for developing a contemporary consumer experience for health care organizations:

- Adopt a hospitality mindset: “delight,” not “satisfaction.”

- Fully address all aspects of creating an optimal consumer experience, including developing a service culture, patient-centered workflows, and enabling tools and technology.

- Address the most important pain points across the entire care journey, not just during a specific touchpoint or episode of care. Focusing on specific touchpoints becomes meaningless if consumers encounter cascading issues at subsequent points in their journey.

Conclusion

While a majority of hospitals and health systems strive to become more consumer centric, Kaufman Hall’s annual Healthcare Consumerism Survey continues to show significant opportunities for improvement across the core areas of access, experience, pricing, and infrastructure. Some health care leaders are looking to develop consumer-centric capabilities internally, while others are seeking help from outside organizations with expertise in specific areas.

Whether built internally or aided by external partners, consumer-centric strategies and capabilities are critical for hospitals and health systems seeking to compete with increasingly larger industry contenders and innovative new entrants. The industry’s historically slow, measured pace of change is working against legacy organizations, causing them to fall further and further behind in a race where the competitors already have significant advantages of greater agility, flexibility, and resources.

Organizations need to rethink their overall delivery model, and look for opportunities to meet consumer needs and expectations head-on. They need to shift from a focus on providing access through traditional brick-and-mortar facilities, to expanding virtual access and digital tools to streamline care and better engage consumers. They need to build real-time consumer experience offerings to enable providers to address patient needs at the time of care, and develop true price transparency across all facilities and services. Lastly, health care leaders should reassess what they are measuring, why they are measuring it, and how they are using that information to best serve consumers.

About the Report

This report is based on the 2019 Kaufman Hall Healthcare Consumerism Survey and the Kaufman Hall Healthcare Consumerism Index. The annual survey is a detailed online questionnaire sent to executives at hospitals and health systems nationwide. Well over 200 executives responded to this year’s survey, representing a broad range of organizations, including community hospitals, academic medical centers, children’s hospitals, and regional and national health systems. Respondents answer questions designed to gauge strategic focus and intent toward being a consumer-centric organization, as well as the resources and capabilities that aid in achieving a consumer-centric organizational core.